multistate tax commission members

The National Nexus Program is a program of the Multistate Tax Commission MTC created by and composed of member states. Section 7-5-3 - Appointment of multistate tax commission member.

A To assist in the conduct of its business when the full Commission is not meeting the Commission shall have an Executive Committee of seven members including the Chairman Vice Chairman Treasurer and four other members elected annually by the Commission.

.jpg.aspx?lang=en-US?width=250&height=306)

. Argued October 11 1977. Helen Hecht General Counsel Multistate Tax Commission Ms. In addition 70 of the members surveyed indicated that confidential information.

86-272 which deals with net income tax including a new section on businesses that interact with customers online and make digital sales. Appointment of multistate tax commission member. The Multistate Tax Commission MTC is continuing to move forward in its efforts to update guidance interpreting longstanding federal legislation that limits states ability to impose income taxes.

The Commission does not. The Multistate Tax Commission MTC1 comprises the tax agency heads of the sixteen states that have adopted the Multistate Tax Compact by statute. Participate in Multistate Tax Commission meetings programs and projects and consult and cooperate with the commission and member states.

T 1 312 602 8517. All other states except Nevada participate as members on some level2 Our mission is to promote uniform and consistent tax policy and administration among the. The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years.

Commission members acting together attempt to promote uniformity in state tax laws. Sovereignty member s are states that support the purposes of the Multistate. If you have questions about the activities of the Muttistate Tax Commission we are available to consult with you.

These states also tend to follow the same practices as member states without having adopted the compact. Revised July 25 2013. NOTE TO TAXPAYERS IN WHICH THE MTC HAS FILED A BRIEF AGAINST YOU - YOUR CHANCES OF WINNING.

Do not participate in the compact. It is the executive agency charged with administering the Multistate Tax Compact. Your tax preparer will go over your information and tax return with you over the phone.

In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth the MTC signatory states interpretation of those in-state activities that are conducted by or on behalf of a corporation and fall within or outside the protection of PL. Examples include if you are undergoing an audit or are curious about the history of the Multistate Tax Compact or Multistate Tax Commission. The Multistate Tax Commission is an interstate instrumentality located in the United States.

These states govern the Commission and participate in a wide range of projects and programs. The Nexus Committee was formed under Article VI2 of the Multistate Tax Compact and bylaw 6 b to oversee the National Nexus Program. To these ends the Compact created the appellee Multistate Tax Commission.

Zacarias Quezada a manager with Marcum LLP provides an overview of the limitations of the law and what it means for businesses. Multistate Tax Commission Members. T 1 513 345 4540.

Multistate Tax Commission June 13 2018 Page 3 of 10. Definition of Member States Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. For further information please contact.

The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co. AssociateProject members are members that participate in. Lila Disque Deputy General Counsel Multistate Tax Commission Mr.

Each member State is authorized to request that the Commission perform an audit on its behalf and the Commission may seek compulsory process in aid of its auditing power in. The Multistate Tax Commission MTC recently updated its guidance on PL. The governor shall appoint the member of the multistate tax commission to represent New Mexico from among the persons made eligible by Article VI 1 a of the compact 7-5-1 NMSA 1978.

The Procedures of Multistate Voluntary Disclosure govern the NNP staff and member states during the process. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law.

This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. These states govern the Commission and participate in a wide range of projects and programs. United States Steel Corp.

T 1 215 814 1743. NM Stat 7-5-3 2016 7-5-3. Please have your cash or check ready.

Upon completion of your return you will be instructed to come back upstairs to sign and pay. NNP staff can explain those more fully if applicable. 86-272 income tax immunity.

They will answer any questions that you have just as we usually do. Law360 November 12 2021 110 PM EST -- The Multistate Tax Commissions executive committee approved Californias request to rejoin the interstate tax uniformity organization ending the Golden. 444 North Capitol Street NW Suite 425.

We do not accept any credit cards. There are currently 16 Compact Members including Colorado Texas Washington and the District of Columbia and 26 AssociateProject members including Illinois New York and California. Brian Hamer Hearing Officer Multistate Tax Commission.

Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate. Gregory Matson Executive Director Multistate Tax Commission Ms. 53 rows The Commission offers services to the public and member states.

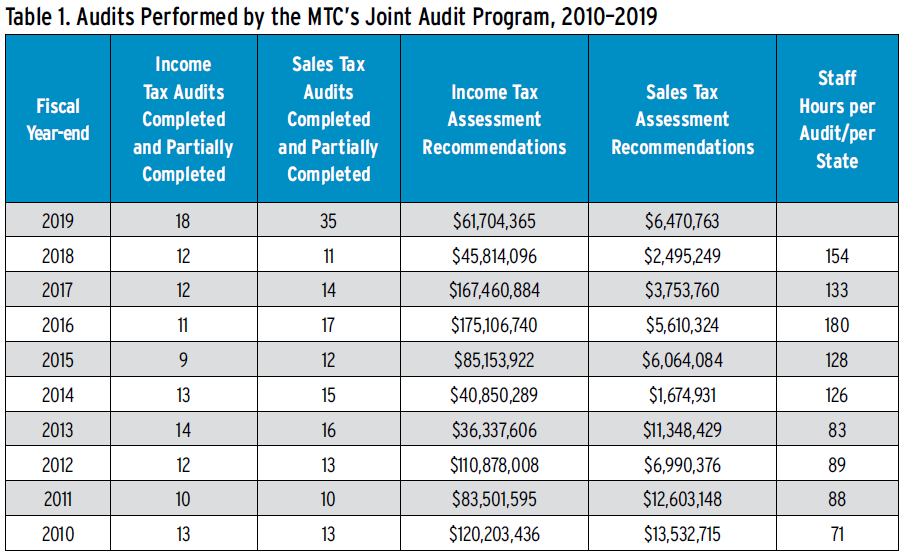

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Gl 22051 Nd Gov Tax Indincome Forms 2008

.jpg.aspx)

Multistate Tax Commission News

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

Uniformity Committee Memo Multistate Tax Commission

Ppt Importance Of State And Local Tax Planning Powerpoint Presentation Id 3058059

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

.jpg.aspx?lang=en-US?width=250&height=306)

Multistate Tax Commission News

Multistate Tax Commission News

Chris Barber Counsel Multistate Tax Commission Linkedin

Uniformity Committee Memo Multistate Tax Commission

Multistate Tax Commission Home

Multistate Tax Commission With Helen Hecht Taxops